One of the persistent themes in pre-IPO Twitter's S-1 filings is that the company has more users outside of the U.S., but when it comes to making money, that shifts drastically - an issue problematic enough that Twitter spells it out in the prospectus as a warning about its business. Today, however, the company launched a new India blog - a sign of how Twitter hopes to address that disparity in one market in particular - perhaps hoping that this huge market, where English is often the common denominator, could be an engine for Twitter's international growth.

To be clear, Twitter is not opening its first official Twitter account or presence in the country. It's actually been tweeting there since February 2010 (first tweet: "What's up?" in Hindi), first as @twi and then @twitterindia.

But it's been, at best, not a full-throttle effort, with only 700 tweets over the last 3 years and 9 months, almost all in English, and many simply spreading information about updates at the wider company. It looks like Rishi Jaitly, Twitter's country director for India, joined in November 2012, although the company made no formal mention of it. The company has also rolled out several of its paid promoted products (prices here, current from January 2013).

The launch of the India blog could be the company's way of showing that it's looking to ramp up its efforts in the country with more localized, public attention.

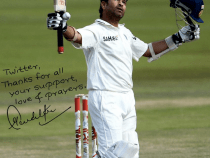

As Jaiatly notes in the post announcing the new India blog, the effort is kicking off with a promotional campaign, #ThankYouSachin, tweeted to India's cricket board, @BCCI, to get a signed picture of sporting legend Sachin Tendulkar as he enters retirement (that picture is illustrated here). In other words, initially Twitter India is using a tried and tested Twitter forumula: the combination of sports, a recognised celebrity/icon, and hashtagging for a little viral buzz.

The upcoming elections in the country could prove to be a strong turning point, too, with Twitter focusing on closer relations with media organizations and political parties to leverage the platform.

It will be interesting to see whether this additional focus - presumably with more campaigns, and a redoubled effort to promote them - can translate into additional users, engagement, and advertising rupees.

Twitter's S-1 paints a clear challenge ahead for the company. "If we fail to expand effectively in international markets, our revenue and our business will be harmed," Twitter notes in the S-1.

But as we have pointed out before, there are some definite positive signs for revenue growth internationally. The company's international revenue was $53 million in 2012, but for the nine months ending September 30, 2013, that went up to $106.7 million, working out respectively to 17% and then growing to 25% of total revenue for those periods.

However, for now, there is little in the way of standout performers internationally for Twitter. "No individual country from the international markets contributed in excess of 10% of the total revenue for the years ended December 31, 2010, 2011 and 2012 and the nine months ended September 30, 2012," Twitter writes. The UK was the first to make the cut in 2013, with $43 million of revenue, or 10% of the total, in the nine months that ended September 30, 2013.

Yes, the UK is an English language market and therefore perhaps more inclined as a result to follow U.S. patterns. But at the same time, it's also a market where Twitter has directed a lot of effort in terms of staffing and focusing on localised content. This is something that Twitter has been building on, deploying several of its top people to run different aspects of its international businesses.

More specifically, Twitter's UK growth is an instructive strategy when you think about India - one of the biggest countries in Asia, with a huge English-speaking population, and relatively free from competitive threats and politically motivated service blocks that Twitter faces in other markets like China.

Today, India doesn't even get a call-out among fast-growing international markets for Twitter. "In the future we expect our user growth rate in certain international markets, such as Argentina, France, Japan, Russia, Saudi Arabia and South Africa, to continue to be higher than our user growth rate in the United States," the company writes.

Part of the reason is down to the fact that, like many other markets, India is shaping up to be mobile-first when it comes to data connectivity. But although India is ramping up fast in smartphone usage (see: iPhone sales) it's still a country largely dominated by less-expensive feature phones, and that has impeded just how much Twitter can do there.

While India doesn't get a name-check for fast-growing markets, it does here: "In certain emerging markets, such as India, many users access our products and services through feature phones with limited functionality, rather than through smartphones, our website or desktop applications," Twitter writes. "This limits our ability to deliver certain features to those users and may limit the ability of advertisers to deliver compelling advertisements to users in these markets which may result in reduced ad engagements which would adversely affect our business and operating results."

Twitter makes clear that it will be spending more money in the future to change this. "We intend to invest in our international operations in order to expand our user base and advertiser base and increase user engagement and monetization internationally," the company writes.

This is, perhaps, long overdue. As of September 30, 2013, Twitter already had more than three times the number of monthly active users outside of the U.S. - 179 million - than it has in the U.S., at 52.7 million. In contrast, revenues are the opposite: in the three months ended September 30, Twitter made $2.58 per user in the U.S., versus just $0.36 per user abroad. It's a disparity that other social networks like Facebook have also found a challenge. Interestingly, we've heard that Twitter has been looking to establish a sales support back office in Hyderabad, folloowing the route Facebook has taken.

Still, it looks like whatever Twitter may have planned for India for now may still be baby steps: Twitter specifically notes four countries where it will be hiring more sales and marketing people - Australia, Brazil, Ireland and the Netherlands. Not India. Whether Twitter looks to invest in another way - with acquisitions that can help it better tackle users on different devices, as Facebook did with acquisitions like Snaptu - remains to be seen.

No comments:

Post a Comment